nevaserial.ru

Community

Can I Make Money With Robinhood

Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Things can change quickly when it comes to the stock market. Make sure to keep a close eye on the market trend page here. Best Robinhood Stocks To Buy Or Watch. Making money on Robinhood is possible, but it's important to remember that investing is risky. You could lose some or all of your investment. Robinhood offers trading for more than stocks and ETFs. Plus users can receive one free stock for referring a friend. Read our expert review for more. The amount of each Robinhood stock reward is randomly assigned. Most people will earn a reward of $5, which they can use to purchase stock, including fractional. Robinhood took the lead in offering zero-commission trading, and other more established retail brokerage firms followed suit in various ways. The widespread. How can I get started on Robinhood with a very very small mount of money to start with? You will either earn some money or stop loss at Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Other fees may apply*. - Earn 3% extra on. Robinhood makes money in many ways, notably through a system known as payment for order flow. That is, Robinhood routes its users' orders through a market maker. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Things can change quickly when it comes to the stock market. Make sure to keep a close eye on the market trend page here. Best Robinhood Stocks To Buy Or Watch. Making money on Robinhood is possible, but it's important to remember that investing is risky. You could lose some or all of your investment. Robinhood offers trading for more than stocks and ETFs. Plus users can receive one free stock for referring a friend. Read our expert review for more. The amount of each Robinhood stock reward is randomly assigned. Most people will earn a reward of $5, which they can use to purchase stock, including fractional. Robinhood took the lead in offering zero-commission trading, and other more established retail brokerage firms followed suit in various ways. The widespread. How can I get started on Robinhood with a very very small mount of money to start with? You will either earn some money or stop loss at Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Other fees may apply*. - Earn 3% extra on. Robinhood makes money in many ways, notably through a system known as payment for order flow. That is, Robinhood routes its users' orders through a market maker.

Robinhood makes money from Payment for Order Flow (PFOF), margin loans, interest on cash, interchange fees on debit card transactions, transfer fees, cash. Instead, the app uses order flow payments to generate revenue. This is a common practice in the financial world. Brokers like Robinhood earn money in exchange. What is much less obvious however is the way in which these apparently “free” brokers such as Robinhood are actually making money to stay in business. To be. Robinhood does indeed make money, in part, by sending customer orders to high-frequency traders in exchange for cash. But so does everyone else! This. Absolutely, you can make money investing in stocks with Robinhood, just as you can with any other brokerage platform. Like other brokerages, Robinhood charges interest on these borrowed funds. It also charges $10 per month for these accounts, but after that all trades are. If Robinhood offers free accounts with no commissions, you may be wondering how Robinhood makes money. The brokerage relies on a controversial practice called. This is my lazy, but practical approach to passively investing in the stock market for free. I'll provide insight into how I used Robinhood. Its no-commission fee model has attracted potential and young investors seeking to earn money through trading and investments. Additionally, Robinhood does not. The first method Robinhood uses to make money is by collecting interest on uninvested money in client accounts. This method is legal and. Robinhood Securities earns fees from banks that participate in its brokerage sweep program when it sweeps uninvested cash in brokerage accounts to those banks. Robinhood Crypto may retain information relating to the Learn and Earn Reward to facilitate the program and/or for training, testing and validation purposes. Make the most of your money with Robinhood Gold · 5% APY on idle cash · Earn while you sleep · Do the math, a $10, balance of uninvested cash can earn you. Yes, you can day trade on Robinhood. Functionally, it works the same as investing does. You buy a stock through the app, and then you sell it later on in the. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. The Financials: How Much Money Does Robinhood Make? · In , Robinhood generated $ billion in revenue. · Robinhood has posted annual net losses for the past. Robinhood is considered safe for investors. It's a member for the Securities Investor Protection Corp. (SIPC), is regulated by the SEC, and has additional. Robin Hood takes a commission out of your gains, meaning they take a little bit of money from the. money you made. second reason is that on Robin Hood. there. You'll be rewarded for bringing and keeping money on Robinhood, whether it's held as cash or invested. Once you earn your boost, it's yours to keep—you can. This is the concept behind Robinhood, an innovative, commission-free trading platform that has democratized access to financial markets for millions. Despite.

Where Can I Add Money To A Cash App Card

Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. Find the prepaid card that works for you at Money Services. Learn More Cash App is a financial platform, not a bank. Banking services are provided. Cash App Cards cannot be added or topped up at ATMs since ATM deposits do not support Cash App Cards. The Cash App Card can be loaded with money. Then you'll be able to withdraw money from your Google Pay balance to your Cash App debit card. Step 1: Add your Cash App Card to Google Wallet. Launch Cash App. Cash App is a popular consumer app in the US that allows customers to bank, invest, send, and receive money using their digital wallet. Cash App Pay is a. Set money aside for a goal or rainy day, and watch it add up. Save Cashing Out transfers your funds from your Cash App balance to your debit card or bank. Launch Cash App · Tap the bank icon in the lower left corner to open the Banking tab · Tap the Add Cash button · Enter the amount of cash you want to add to Cash. Set money aside for a goal or rainy day, and watch it add up. Save Cashing Out transfers your funds from your Cash App balance to your debit card or bank. You can deposit money into your Cash App balance at many participating retailers. Set up direct deposits: You can also deposit paychecks, tax returns, and more. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. Find the prepaid card that works for you at Money Services. Learn More Cash App is a financial platform, not a bank. Banking services are provided. Cash App Cards cannot be added or topped up at ATMs since ATM deposits do not support Cash App Cards. The Cash App Card can be loaded with money. Then you'll be able to withdraw money from your Google Pay balance to your Cash App debit card. Step 1: Add your Cash App Card to Google Wallet. Launch Cash App. Cash App is a popular consumer app in the US that allows customers to bank, invest, send, and receive money using their digital wallet. Cash App Pay is a. Set money aside for a goal or rainy day, and watch it add up. Save Cashing Out transfers your funds from your Cash App balance to your debit card or bank. Launch Cash App · Tap the bank icon in the lower left corner to open the Banking tab · Tap the Add Cash button · Enter the amount of cash you want to add to Cash. Set money aside for a goal or rainy day, and watch it add up. Save Cashing Out transfers your funds from your Cash App balance to your debit card or bank. You can deposit money into your Cash App balance at many participating retailers. Set up direct deposits: You can also deposit paychecks, tax returns, and more.

If you get paid using Cash App, you can easily link your Found account to your Cash App account, to transfer funds between the two accounts card connected to. Thanks to the Internet, it's very simple to transfer money to your Cash App card from your bank account, debit card, or Cash App balance via your computer or. Ways to load & unload money · Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal. Cash App is one of a host of new peer-to-peer cash (P2P) transfer apps, including PayPal, Venmo, and Google Pay, that make it easier to exchange money, split. It's easy. 7 11, rite aid, walmart all allow you to put cash money on your cash app account. Steps are easy. Open up the. Cash App Pay is currently available for businesses processing payments on Square Register, Square Stand, and Square Terminal, as well as Square Point of Sale. Update your Chipper Cash app to the latest version · Launch the app and log into your account · Tap on the Add Cash button on your Homepage · Claim your USD. Open Cash App; Click the “Cash Card” tab; Click “Get Cash Card”; Click “Continue”; Follow the remaining steps. And finito. Then you'll be able to withdraw money from your Google Pay balance to your Cash App debit card. Step 1: Add your Cash App Card to Google Wallet. Launch Cash App. Cash App Card is the instant discounts, no-hidden-fee, secure debit card that you design. Use it everywhere VISA is accepted. Free to order. Open your cashapp. In the bottom left corner where it shows your balance (the spot you click to add money) tap that. Just below your balance it says more ways. Use it for Payments, Banking, Investing, the Cash App Card, and offers. Payments. Send and receive money with anyone, donate to an important cause, or tip. Apple Vision Pro: Open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Add Money. Enter an amount. The minimum is $ Tap Add. 1. Open Cash App on your smartphone · 2. Enter the amount of money you want to send · 3. Tap “pay” on the screen · 4. Enter the recipient's name, email address, $. Yes, Cash App is among several person-to-person payment apps to which you can usually link a credit card to send money and to pay bills. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Simply set up the feature, and use the app from your phone. You can add funds from a bank account or from a credit card. Then, you can venture out with just. Simply set up the feature, and use the app from your phone. You can add funds from a bank account or from a credit card. Then, you can venture out with just. open Cash App and go to the Money tab, then tap Deposit Paper Money to view the map of participating retailers.". Step 1. Locate Your Store ; Step 2. Scan Your Barcode on Your App* ; Step 3. Load Your Cash.

Somewhere To Cash A Check Near Me

All you need to cash a check is a valid government-issued ID.#. Created with Cash Express locations in the state where you originated your loan. In. Q: What do I need to bring with me in order to get an Amscot Cash Advance? A **We do not check credit, but we do check your status in the Florida. Regions offers check cashing services — including handwritten, out-of-state, insurance, two-party, tax refunds, business, government and payroll. You can find a location near you at HRA Benefits Access Centers. In How can I check the status of my Cash Assistance application? Online. You can. We didn't find any, for example, that accepted cashiers checks. Some properties won't allow you to cash a check there if you've cashed one somewhere else within. Places Where You Can Cash a Check; What to Consider Before Cashing a Check near you. Sometimes that bank will allow a non-customer to cash a personal. We are New York's largest, and most convenient check cashing place. We cash all types of checks including payroll, government, and tax refund checks. Cash Checking · Walmart Pay · Express Money Services · Tax Prep Services · Bill Pay checks printed. To learn more about which MoneyCenter transactions are. A few options: Walmart cashes personal checks under (there is a fee). Cashapp /Venmo/Walmart money card has option to do mobile deposit. All you need to cash a check is a valid government-issued ID.#. Created with Cash Express locations in the state where you originated your loan. In. Q: What do I need to bring with me in order to get an Amscot Cash Advance? A **We do not check credit, but we do check your status in the Florida. Regions offers check cashing services — including handwritten, out-of-state, insurance, two-party, tax refunds, business, government and payroll. You can find a location near you at HRA Benefits Access Centers. In How can I check the status of my Cash Assistance application? Online. You can. We didn't find any, for example, that accepted cashiers checks. Some properties won't allow you to cash a check there if you've cashed one somewhere else within. Places Where You Can Cash a Check; What to Consider Before Cashing a Check near you. Sometimes that bank will allow a non-customer to cash a personal. We are New York's largest, and most convenient check cashing place. We cash all types of checks including payroll, government, and tax refund checks. Cash Checking · Walmart Pay · Express Money Services · Tax Prep Services · Bill Pay checks printed. To learn more about which MoneyCenter transactions are. A few options: Walmart cashes personal checks under (there is a fee). Cashapp /Venmo/Walmart money card has option to do mobile deposit.

in cash at a participating agent location. Start your transfer on the Western Union app, or at nevaserial.ru check cashing near nevaserial.ru Home · About · Contact · Locations Your customers cash checks somewhere. Why not start their week in your store? SAM Machines. Check online or call customer service to find additional locations. You can use the ATM to deposit cash or checks to your Capital One checking account. Then. somewhere else where your executor can access it without jumping through legal hoops. Again, store copies of your will in your safe deposit box for backup. Here are some places you can go if you need to cash a check after hours. The easiest way to find check cashing near you is to search Google Maps. Which means, even if you bank somewhere different than your friends and Check with your financial institution. 2Based on a Q4 survey of. Buy or Sell bitcoins for cash. There are many services and locations apart from bitcoin ATMs which provide exchange of bitcoins for cash and vice versa. There are a few near Hollister/Tidwell. How do I know? My me to verify the check before cashing it. Upvote 3. Downvote Reply reply. Check Deposit FAQ. Review answers to commonly asked questions about using check deposits. How do I deposit a check from my Square Point of Sale app? They told me to go somewhere else and refused me. Helpful 0. Helpful 1. Thanks Western Union Locations in South San Francisco · Payday Loan in South. Use our store locator to find The Check Cashing Store location near you in Florida. Cash all your Commercial Checks with A-One Check Cashing. Drop into any of our 20 locations throughout Houston! . *Some restrictions. Poor service the girl was on face book and didn't even bother to help me so I left. Places Near Houston with Check Cashing Service. Someone would give me a check drawn on Bank of America. I'd take the check to the closest Bank of America branch, which was a little over a mile. We cash checks at most Hannaford stores, click the link above for details. About Store Locator · FAQs · Product Recalls · Web Accessibility · Privacy · Terms. They told me this check is a church charitable there is no fee at all. I A 20percent damn near is crazy gtfoh read more. Helpful 0. Helpful 1. Thanks. The app ask for all my info including my ss# just to decline my check and also locked me out of my account. Now I tried cashing my check somewhere else and it. Further, Does my father need to declare somewhere that it is a gift from him? Finally, it is possible for him to gift me cash over transfers within a year? Get more information for A-1 Check Cashing in Houston, TX. See reviews, map, get the address, and find directions. Q: What do I need to bring with me in order to get an Amscot Cash Advance? A: Proof of income (pay stub, direct deposit, bank statement, etc.), your check or.

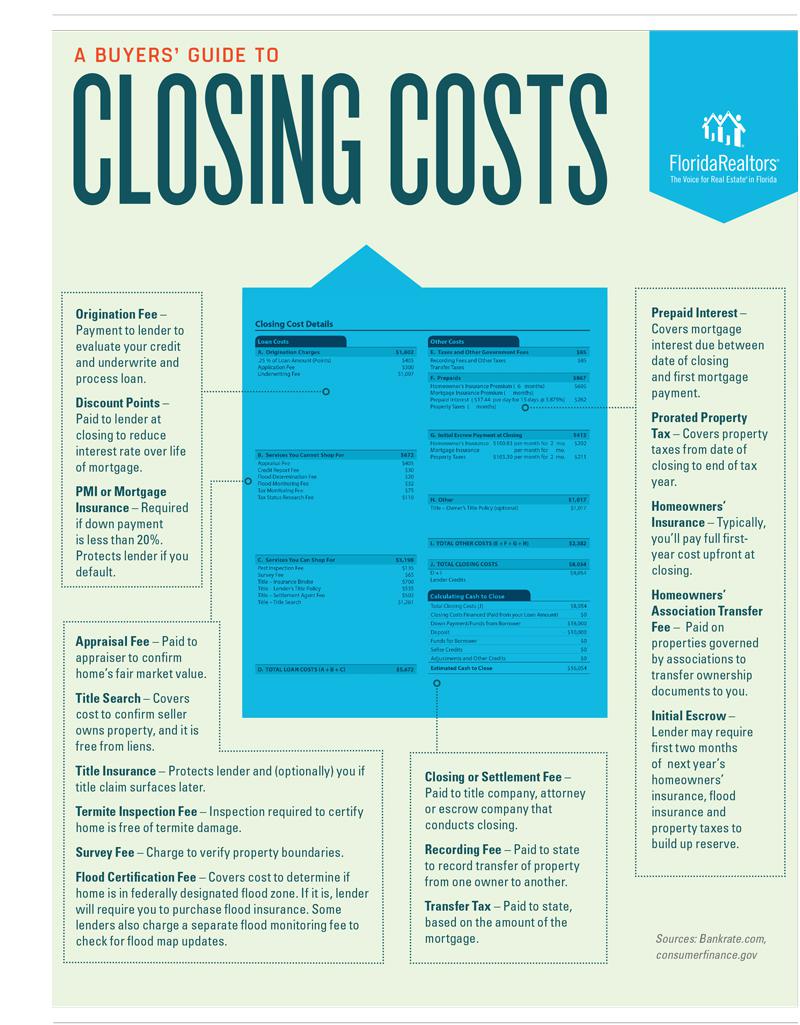

How Do I Know What My Closing Costs Will Be

A good rule of thumb is % of the purchase price of the home should be put aside for closing costs. What You Should Know · Closing costs are the fees that are paid by both the seller and buyer of a home for various services that are required before closing on. Our closing costs calculator uses local data to show you price ranges for common fees to help you budget. Shop around for the best terms. Closing Cost Calculator ; nevaserial.ru's FeePay Best Way closing cost calculator will allow you to run the numbers for a traditional method of paying those costs out-. Typically, you should be prepared to pay between 2% and 5% of the home purchase price in closing fees. Estimate your total closing expenses for purchasing a. Estimated closing date. The estimated date that the actual home sale will take place. This date is used to determine the prepaid interest due on the mortgage. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. The bulk of the. Most realtors and financial advisors tell you that closing costs will typically be in the range of % of the home value. This may seem reasonable enough, but. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. A good rule of thumb is % of the purchase price of the home should be put aside for closing costs. What You Should Know · Closing costs are the fees that are paid by both the seller and buyer of a home for various services that are required before closing on. Our closing costs calculator uses local data to show you price ranges for common fees to help you budget. Shop around for the best terms. Closing Cost Calculator ; nevaserial.ru's FeePay Best Way closing cost calculator will allow you to run the numbers for a traditional method of paying those costs out-. Typically, you should be prepared to pay between 2% and 5% of the home purchase price in closing fees. Estimate your total closing expenses for purchasing a. Estimated closing date. The estimated date that the actual home sale will take place. This date is used to determine the prepaid interest due on the mortgage. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. The bulk of the. Most realtors and financial advisors tell you that closing costs will typically be in the range of % of the home value. This may seem reasonable enough, but. Use this calculator to determine how much you should expect to pay in closing costs on your home loan.

Answer: Your exact closing costs will be based on the circumstances of your loan. To give you a general idea — the majority of our loans from the past year. 1 Thus, if you buy a $, house, your closing costs could range from $6, to $12, Closing fees vary depending on your state, loan type, and mortgage. Closing / Escrow / Settlement fee: Most time you need a settlement agent to facilitate your transaction. Your title company or attorney generally will act as a. What you need to know about closing costs · Your closing costs, which will depend on your lender, type of mortgage, and home location, may cost thousands of. Use SmartAsset's award-winning calculator to figure out your closing costs when buying a home. We use local tax and fee data to find you savings. Buyer closing costs are real estate transaction fees that are paid in addition to your down payment and mortgage amount - including taxes, title insurance. This calculator allows you to select your loan type (conventional, FHA or VA) or if you will pay cash for the property. It will then estimate your total. How do you calculate closing costs? · Purchase price: Closing costs are often estimated to be between 2% and 5% of the final sale price of your house, according. Closing costs are the fees and expenses you'll need to pay when you close your loan. On average, closing costs are around % of the loan amount. They may. Credit report — As part of the due diligence to determine your credit worthiness and determine the interest rate for your loan, the lender will pull your credit. How much are closing costs? Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property. “Credit for $5, to go toward closing costs will be a much greater bang for the buyer's buck. The price reduction won't amount to much more than a few dollars. So, on a $, home purchase, you could pay between $5, and $12, in closing costs. Your mortgage loan officer can help you figure out the best way to. Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. · Both buyers and sellers may be subject to. Keep in mind: After the loan closes, the property may be reassessed, and the value could increase along with the real estate tax. Escrow amounts may also need. What will my closing costs be on my home purchase? Closing costs vary, but you can expect to pay anywhere from 2% to 6% of the loan amount. These fees don't. Closing costs include taxes, lender fees and title fees that a homebuyer pays at settlement. Watch this video to prepare for the process. Browse all videos. Third-Party Closing Costs: $3, ; Recording Fee, $ ; Notary Fee, $ ; Title Insurance, Average % of purchase price (or loan amount in a refinance). Closing Cost Calculator A mistake that buyers often make is that when calculating the price and affordability of their future home, they do not take into. When a property's title changes hands, government agencies will need to legally record the change in ownership and any documents related to your mortgage.